It’s extremely rare to find politicians in complete agreement about anything – especially taxes.

But every candidate in the Oct. 15 election for mayor or council in Prince Rupert, plus the current outgoing mayor and council, has joined a battle to make the Port of Prince Rupert pay more taxes.

The issue is being framed by these local politicians as a fight between little guys and big guys – citizens versus multinational corporations.

Taxes on people and businesses are too high in Prince Rupert, argues a campaign called #ScraptheTaxCap, which describes itself as a “citizen-driven petition to the Province of BC”. Locals need a break, argues the campaign, not “multinational corporations with hundreds of billions in annual revenues, most with foreign-based headquarters.”

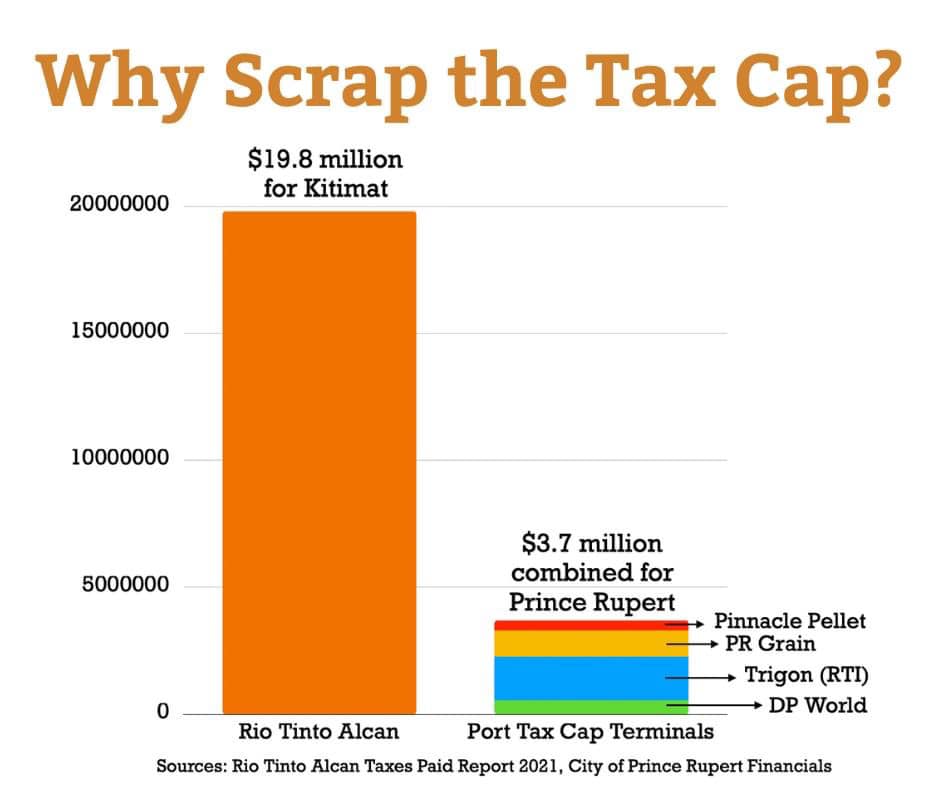

At issue is a provincial limit on taxes paid to the city by the Port of Prince Rupert. The cap, which also covers other major terminals in other B.C. cities, was set in 2004 by the then-B.C. Liberal government.

Advocates of the cap say that it aims “to provide stability and predictability to the taxation environment of port terminals within the province to attract investment and position BC as a competitive global trade gateway,” explains the Port website.

The cap was introduced as temporary, but made permanent in legislation in 2014. The province compensates cities – but not by as much as the foregone taxation.

But the port is now thriving, and with people and businesses in Prince Rupert facing higher taxes, and money needed for infrastructure, all local politicians have joined a campaign, and signed the petition, to “#ScraptheTaxCap.”

“We lose revenue every year from it,” outgoing mayor Lee Brain said this week, as council voted to demand more money for Rupert’s infrastructure from the province.

Back when the cap was set, Herb Pond, Prince Rupert’s then-mayor, argued the port was in serious trouble. Pond is again running for mayor, and while the cap “likely saved” Prince Rupert’s coal and grain terminals then, he said in a Facebook post, now it needs to be scrapped.

For every $1 in port investment only 5.4 cents was taxable,” opponents of the cap argue.

The anonymous group – which did not reply to a request for an interview – cited a report that as the “capped” port terminals invested billions, the taxable portion increased by a small fraction.

“We support a growing port!” stresses the online petition signed by about 1,200 people. The campaign notes the port generates 3,700 direct jobs in Prince Rupert. “We all want to see the port continue to grow – just not at our expense.”

The petition asks any B.C. citizen to sign, and also to write to provincial finance minister Selina Robinson, municipal affairs minister Nathan Cullen, North Coast MLA Jennifer Rice, and former cabinet minister David Eby, who is now campaigning to become the next leader of the B.C. NDP party, and premier.

“We don’t want to continue having major multinational corporations downloading the tax costs of … growth down to the everyday homeowner and small business owner in Prince Rupert,” argued council candidate Reid Skelton-Morven in an election campaign post on Facebook.